BUDGETS & PROPERTY TAX RATE INFORMATION

Budgets

Property Tax Rate Information

The City's property tax rate consists of two components: Maintenance & Operations (M&O) and Debt Service (I&S).

The Tax Year 2025/Fiscal Year (FY) 2026 tax rate per $100 of taxable value is as follows:

- M&O: $0.497818

- I&S: $0.047222

- Total tax rate: $0.545040

NOTE:

City of Leon Valley Property Taxes are billed and collected by the Bexar County Tax Assessor Collector’s Office.

We have an agreement with the Bexar County Tax Assessor-Collector’s Office to provide property tax billing and collection services. The Bexar County Tax Office offers the options of paying taxes online or by phone. Click here for more information: Pay Taxes Online | Bexar County, TX - Official Website

For questions, call the Bexar County Tax Assessor-Collector’s Office at 210-335-2251.

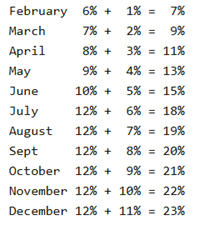

Property Tax Late Charges

Taxes become delinquent if not paid by the due date. A delinquent tax incurs interest at the rate of 1% for the first month and an additional 1% for each month the tax remains delinquent.

In addition to interest, delinquent taxes incur the following penalties:

- 6% for the first month

- an additional 1% for each of the following 4 months

- an additional 2% for the sixth month, for a total of 12%

Exemptions

The City offers property tax exemptions to the following property owners:

- Persons with a residence homestead are entitled to a 20% exemption of the market valuation of their home

- The Over-65 exemption is for property owners who claim their residence as their homestead - this exemption is a maximum of $50,000 of taxable valuation

- A disabled person may qualify for a $50,000 disabled residence homestead exemption

Applications for exemptions must be submitted to the Bexar Appraisal District. The Residential Homestead Exemption Form along with other forms used at the Bexar Appraisal District can be found on their website.

See the Calendar For Property Owners and the Historical Property Tax Rate Table for more information.

For questions, call the Bexar Appraisal District at 210-224-2432.